On Monday, June 8, 2020, the National Bureau of Economic Research (NBER) announced that the U.S. economy is officially in a recession. This did not come as a surprise to many, as the Bureau defines a recession this way:

“A recession is a significant decline in economic activity spread across the economy, normally visible in production, employment, and other indicators. A recession begins when the economy reaches a peak of economic activity and ends when the economy reaches its trough. Between trough and peak, the economy is in an expansion.”

Everyone realizes that the pandemic shut down the country earlier this year, causing a “significant decline in economic activity.” Though not surprising, headlines announcing the country is in a recession will cause consumers to remember the devastating impact the last recession had on the housing market just over a decade ago.

The real estate market, however, is in a totally different position than it was then.

As Mark Fleming, Chief Economist at First American, explained:

“Many still bear scars from the Great Recession and may expect the housing market to follow a similar trajectory in response to the coronavirus outbreak. But there are distinct differences that indicate the housing market may follow a much different path. While housing led the recession in 2008-2009, this time it may be poised to bring us out of it.”

Four major differences in today’s real estate market are:

- Families have large sums of equity in their homes*

- We have a shortage of housing inventory, not an overabundance

- Irresponsible lending is no longer the “norm”

- Home price appreciation is not out of control

*The first quarter of 2020’s Financial Accounts of the United States , the Federal Reserve’s flow of funds data, show the aggregate values of households’ assets and liabilities in the nation. Households’ real estate assets totaled $30.3 trillion and liabilities totaled $10.7 trillion, making homeowners’ equity $19.7 trillion or 65% of total household real estate. Net household equity, determined by the difference between households’ assets and liabilities, serves as an alternative means of financing for single-family homeowners. For the first quarter, net equity’s share of households’ real estate assets’ value increased from the previous quarter by one quarter of a percentage point. This phenomenon may owe more to home price appreciation as, according to the financial accounts, in the first quarter the outstanding value of home equity loans (including home equity lines of credit but excluding all loans held by individuals) taken out on one-to-four family residential mortgages decreased by $6 billion to $495.3 billion on a non-seasonally adjusted basis.

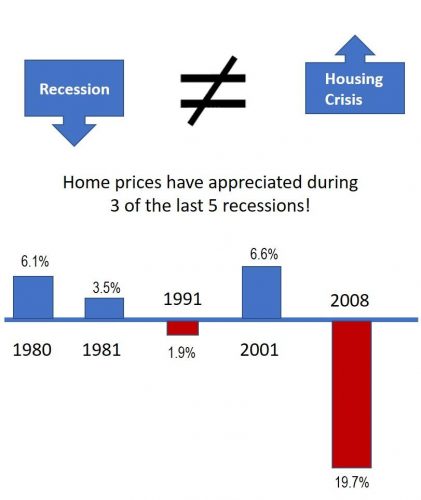

We must also realize that a recession does not mean a housing crash will follow. In three of the four previous recessions prior to 2008, home values increased. In the other one, home prices depreciated by only 1.9%. (Source: CoreLogic)

Bottom Line to Relocation

Yes, we are now officially in a recession. However, unlike 2008, this time the housing industry is in much better shape to weather the storm. With unemployment rates declining, job opportunities rising, and the Federal Reserve holding federal rates between 0% – 0.25% the nation continues to deploy the tools needed to underwrite an emerging recovery for the U.S. economy. In particular, the Fed is making sure that credit is available for households and businesses to ensure the smooth operation of markets. Housing and home building are important elements for the transmission of monetary policy and will thus feature as front-line sectors during a recovery.

Have questions or want to learn more about Lawrence Relocation Services, please contact Ginny Taylor, Director of Relocation Services, by email or by phone at 540-966-4550.